How it works

Changes to the company lists or fund rating methodologies will be reflected below.

Spreadsheet downloads for the Invest Your Values mutual fund and ETF scorecards will be hosted exclusively on the As You Know data platform beginning in early 2026. For ongoing access and updates, please contact [email protected].

Tobacco Free Funds sources financial data on equities and mutual funds from SEC's Edgar database. Our tool contains information on thousands of U.S. open-end and exchange traded mutual funds, some of the most common funds held in 401(k)s, 403(b)s, and other retirement plans.

Search for mutual funds using name or ticker symbol. Use the search page to filter funds by investing style, fund family, regional market, and more. We don't have everything in our database - we only screen mutual funds that own stocks, and can only display up to 3,000. Looking for your favorite fund and can’t find it? With more resources, we could include more funds - make a gift today to make a difference.

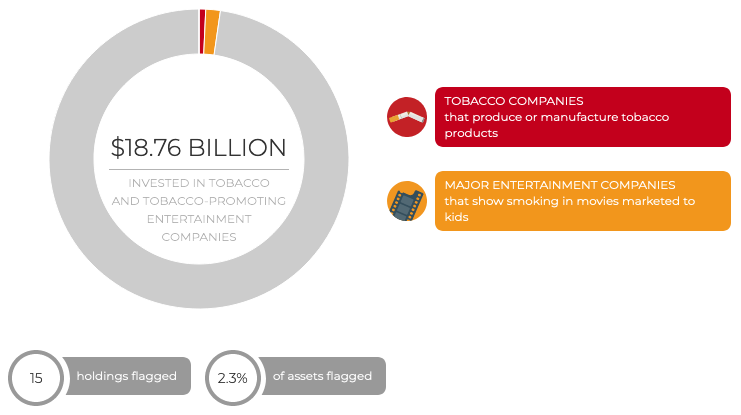

For each mutual fund in our database, we examine every holding and determine if it is a stock issued by a tobacco company or a tobacco-promoting entertainment company.

Holdings that are not stocks, like currencies, bonds, or other mutual funds, are not rated. A fund’s Percent Rated value is equivalent to the percent of the fund that is invested in stocks. The higher a fund’s Percent Rated value, the more holdings we were able to examine. A fund with a lower Percent Rated value may have hidden tobacco-related investments that our tool cannot account for.

Two screens are applied to each fund – a list of tobacco companies, and a list of entertainment companies that promote tobacco to young audiences.

Mutual funds can have a varying number of holdings, from less than one hundred to several thousand. We calculate the total number of flagged holdings in the fund, and the total amount and percentage of the fund’s assets that are invested in those companies.

If a fund has investments in tobacco producers or tobacco-promoting entertainment studios, you'll see a chart like this showing the details:

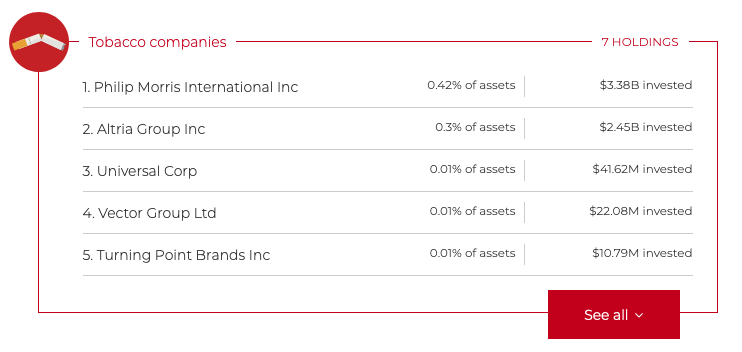

You'll also see a list of all the specific tobacco investments of that fund's portfolio.

Based on whether or not a fund has investment in tobacco companies and/or tobacco-promoting entertainment companies, we assign a letter grade.

These thresholds reflect the distribution of results across funds, placing an approximately equal number of funds from the analysis universe in the C, D, and F grade ranges.

We apply a "sustainability mandate" indicator to funds that make investment decisions based on environmental and social risk issues like environmental responsibility or human rights. A sustainable fund may take a proactive stance by selectively investing in, for example, environmentally-friendly companies, or firms with good employee relations. They may also avoid investing in companies involved in promoting alcohol, tobacco, or firearms, or in the defense industry.

The Forum for Sustainable and Responsible Investment is a group advancing sustainable, responsible, and impact investing. Asset managers who are members of US-SIF often have policies to exclude or restrict investments in companies involved in the production, licensing, and/or retailing of civilian firearms. Look for this symbol to find funds that are members of US-SIF.

When you're done looking up funds and finding the data you need, what's next? You can learn how to make a change and move your money with our tobacco free action toolkit. Whether you’re an individual investor or if your investments are in your employer-sponsored plan at work, our step-by-step toolkit can help. There's an in-depth guide to responsible investing, links to external resources, a sample letter to send to your employer 401(k) manager, and more — everything you need to make a change and get started investing your money tobacco free.

Disclaimer: As You Sow is not an investment adviser

See our full disclaimer